Hello and welcome to the next blog. In this blog I will be writing about complete end to end process cycle of withholding tax in D365.

Most of us, post transactions in D365 but payments and settlements perform outside system which ends up in posting manual rentiers for TDS payable and Payments.

No worries, after this post, you will suggest the complete withholding process within system to customer.

Pre-requisite: Enable TDS calculation in General ledger parameters > Sale Tax

So, lets do with the use case.

Scenario: Here are the three steps for end to end process:

- All TDS payable transactions in system with following expected entry:

Vendor Debit to TDS Payable Credit

- Once process withholding payments process/settlements:

Vendor (Withholding authority) Credit to TDS Payable Debit

- Payment Process with challan details:

Vendor (Withholding authority) Debut to Bank Credit

- Configuration

Step-1: Create Withholding authority

Navigate, Tax > Indirect Tax > Withholding tax > Withholding tax authority

Step-2: Create Withholding settlement period

Navigate, Tax > Indirect Tax > Withholding tax > Withholding settlement period

Step-3: Create Withholding component group and component code (TDS/TCS)

In this setup, we can specify the section codes e.g. 194 C, 194 J in Indian taxation, perform same steps for both TDS and TCS

Navigate, Tax > Setup > Withholding Tax > Withholding Tax component group/code

Step-4: Create Withholding tax code and “Rate”

Navigate, Tax > Indirect Tax > Withholding tax > Withholding tax code

Step-5: Create Withholding tax group and Map to designer

Navigate, Tax > Indirect Tax > Withholding tax > Withholding tax group

Step-6: Map TAN number for all the addresses which will be used in Transaction posting

This must be done in legal entity addresses and site/warehouse address > Tax information

Step-7: Enable Vendor/Customer master for withholding Tax calculation

Navigate, All vendor/Customer > Edit > Invoice tab

Note: This is mandatory step

- Transactions

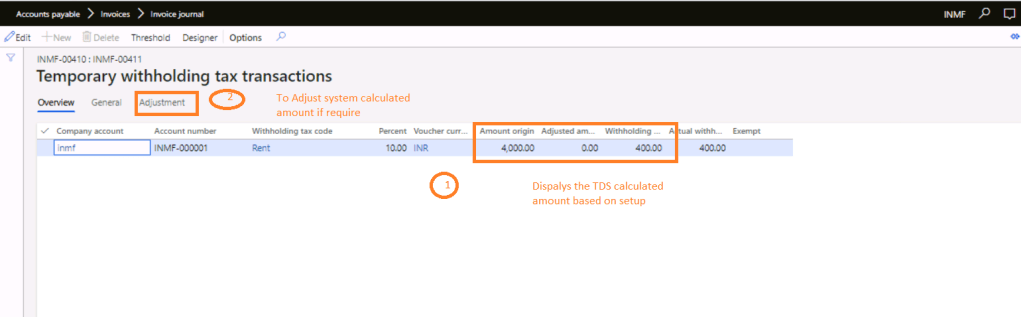

Step-1: Create Invoice for TDS, Validate TDS amount, Post

Vendor Debit to TDS Payable Credit

Step-2: View withholding tax transactions

Navigate, Tax > Inquiries and Reports > Withholding Tax transactions

- Withholding tax Payment and Settlement

Step-1: Process Withholding tax payment process

This step is to process in month end based on settlement frequency defined in setup, this must be run for each TAN number

Navigate, Tax > Withholding tax > Declaration > Withholding Tax Payment

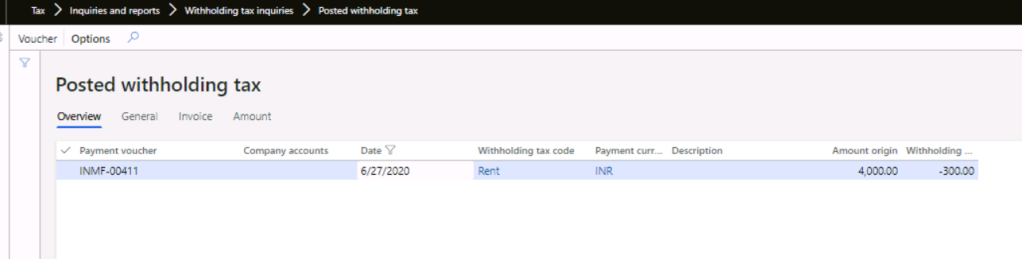

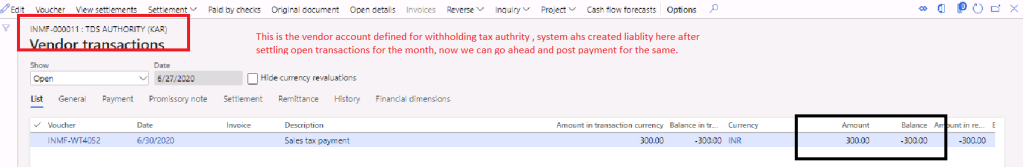

Step-2: View Open transactions in Tax Authority Vendor

Navigate, Vendor > Open > Transactions

TDS Payable Debit to Vendor Credit

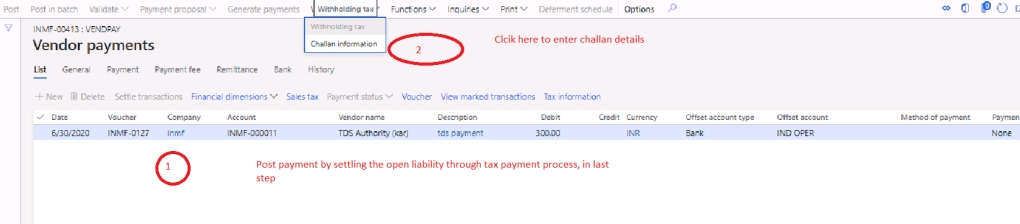

Step-3: Payment of Settlements, Create and post Payment journal

Vendor (Tax Authority) Debit to Bank Credit

Step-4: Enter Challan Details

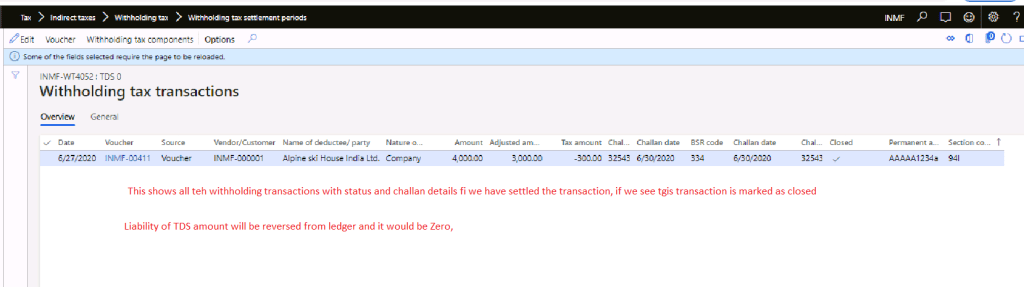

- View of final withholding tax payments and settled transactions

Navigate to, Tax > Indirect Tax > Withholding Settlement Period

That is it for this blog, hope this will help you in better process design for customer next time.

Thank you for reading keep sharing in your network. I will be back with next part with some more scenarios.

Hi Saurabh!

Thanks for this nice explanation!

After filling the challan details in the posted voucher, that challan details are not updated in the Withholding Tax Transactions (from Tax Settlement period page). I made the payment from General Journals. Is it make any difference?

Please share your experience if you have faced such issues while configuring.

Thanks & Regards

LikeLike

I need to check Neeraj, did you try same from payment journal?

LikeLike

Hi Saurabh,

Nice article, really useful to us.

One question: How would this process work if we have multiple legal entities but with the same TAN (branches of the same company) ?

Thanks,

Pankaj

LikeLike

Hi Pankaj, sorry for delay response.

If same TAN but we are maintaining two different legal entity we can generate filing in both entities separately.

LikeLike

Hi there would you mind stating which blog platform you’re using? I’m looking to start my own blog in the near future but I’m having a tough time making a decision between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design seems different then most blogs and I’m looking for something unique. P.S My apologies for being off-topic but I had to ask!

LikeLike

Hi Saurabh,

Very useful information.

Can you please let me know where should we enter the token numbers and how do we genrate the TDS and TCS statemet by using TDS and TCS report.

Thanks

LikeLike

We have an option to enter Token Number and how to enter it?

This will need to download Form 26 Q or Form 26 AS which need to be issues to respective Vendors or customers.

LikeLike

We have recently migrated from the legacy system to d365. We have brought only Open balances of the vendor to the D365. However, there are some TDS code which is applicable only if the purchase crossed 50 Lakh. But since we have only brought opening balances which is very less than 50 L, the system is not calculating TDS on it. how this scenario will be handled. Users are expecting the system to calculate TDS becoz they already did the transaction more than 50 L in the previous system.

LikeLike

Hello, How to manage Concessional rate against concession certificate by Vendor for Withholding Tax. Eg. Vendor X has issue certificate to deduct TDS at 1% instead of normal rate of 10%

LikeLike

Hi , there tds threshold option available which you can specify for any specific rule

LikeLike